The aim of this article is to give you all the tools and techniques to improve and develop techniques for budgeting for loan repayments.

Do you have the resources to pay off your loan after taking one out?

A budgeting plan will allow you to do the following:

- Be more in control of your finances

- Avoid falling into a neverending debt cycle

- Help to reduce stress

- Enable you to better plan out your future.

Budgeting for loan repayments takes some organisation. Here is a step-by-step guide on how to do it.

Understand the real meaning of budget

A good budget should record the following:

- Actual income

- Projected income

- Expenditures over a period of time

There are many resources out there to help you to budget, from apps to budgeting experts, to websites. We recommend Just Budget’s free online budget calculator because you receive a clear tangible solution at the end.

When budgeting for loan repayments, you should consider the following before making a decision about spending.

What is important to me?

Are you willing to trade off a comfortable retirement for a holiday in the Caribbean? Do you want to eat at nice restaurants and charge them on credit cards, copping interest in the process? Would you prefer to pay for your children’s education instead of purchasing an extravagant model of car?

Each of us have our own priorities. Someone else’s priorities may seem to be trivial to you. A simple event can be other person’s bucket list experience. Your choices depend upon what is significant for you. Sadly, a lot of people get into debt for things that do not really matter to them in the grand scheme of things.

How do I want to live?

Nobody wants to live below the poverty line and not everyone is comfortable with debt. But, when a crisis occurs, such as family breakdown, health issues or unexpected changes, you may be forced to go into debt — which may be too great for you to handle.

Thinking about creating a debt management strategy, could help you handle debts and free up a little income to meet your daily expenditure.

How can I accomplish my financial goals?

Visualise your future

By smartly utilising your income, you could live comfortably even if you have debts. The challenge is to bridge the gap between your present situation and your vision.

You can ask yourself, ‘If I want to be that person, what can I do right now to get there?” The answer may be uncomfortable for you at first, but when you see that you are getting through with it with flying colours, you will be encouraged to continue until you succeed.

Set realistic and achievable financial goals

What are your long-term and short-term goals?

Do you wish to save $50,000 for a down payment to your dream house or do you want to be totally free from debt in 5 years’ time? Your goals should be specific. Put a deadline for each of them and review or adjust those goals until you accomplish them.

For example, if you want to have a comfortable retirement, define ‘comfortable’. When do you want to retire? How much money do you want to receive each month? Where do you want to live?

Set short-term goals or those that you can accomplish in less than a year. Perhaps you want to pay off your $1,000 credit card debt in 6 months or save $2000 for a nice pair of shoes for Christmas.

Make a plan on how to accomplish your goals

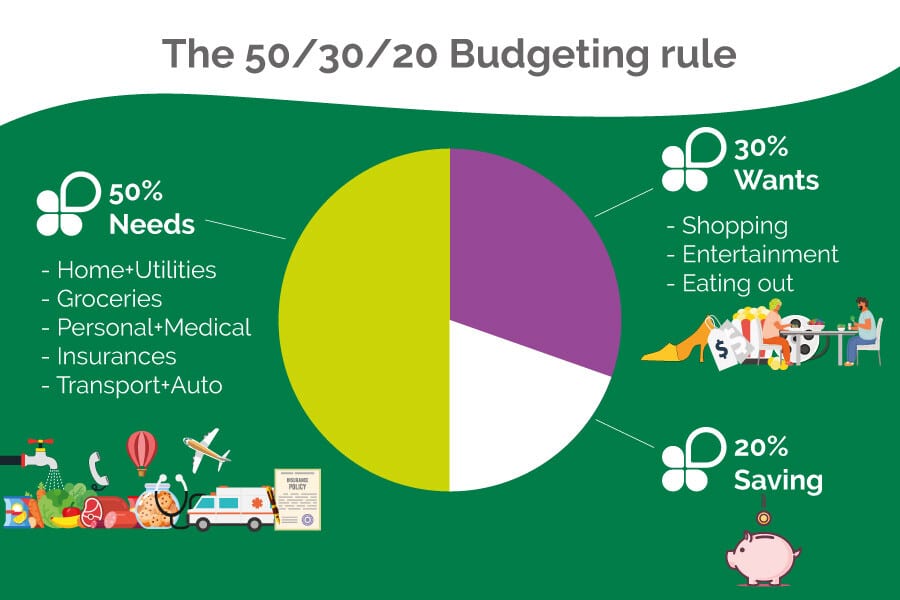

When budgeting for loan repayments, there are three factors to consider when creating a strategy:

- Income: How much money do you make? Do you have 1 income stream or do you have a side hustle? Could you find other ways to increase your income?

- Outgoings: Consider your fixed (wifi, rent) and variable expenses (groceries, electricity), and your debt repayments. Also consider how much spending money you typically spend.

- The result: If your monthly income is greater than your average monthly expenses + minimum debt repayments then you can decide what to do with the suplus. Will you put it towards paying off debts faster? Will you use it to treat yourself to material goods, holidays or dining out? Or will you put it aside for future savings or an emergency fund?

Do you feel like there’s no way out of your current situation?

If you feel as though you are drowning in debt then things can get complicated.

You may choose that debt consolidation is the right solution for you. This entails taking out a loan whereby your current debt are combined into 1 repayment with fixed or no interest and lower total fees with a clear repayment structure.

If you are making less than the total of your expenses and debts then debt you may want to consider debt relief where your repayments are stretched out into lower amounts over a longer period of time, so you can afford them and stop being overwhelmed by debt repayments.

Some final notes when budgeting for loan repayments

If you are not already too deep in debt, then budgeting for loan repayments can be fairly straightforward. It just takes a clear vision, some careful planning and discipline to find your way out.

Sometimes, you have to make tough decisions to escape the debt cycle. If you need a hand with budgeting then Australian Lending Centre are only a phone call away.

Budgeting takes hard work and perseverance, but the results speak for themselves. Use these budgeting tips to help you to manage your finances and soon you’ll be in a good position to reach your savings goals. If you need a bit of extra help managing your money, get in contact.

Budgeting takes hard work and perseverance, but the results speak for themselves. Use these budgeting tips to help you to manage your finances and soon you’ll be in a good position to reach your savings goals. If you need a bit of extra help managing your money, get in contact.