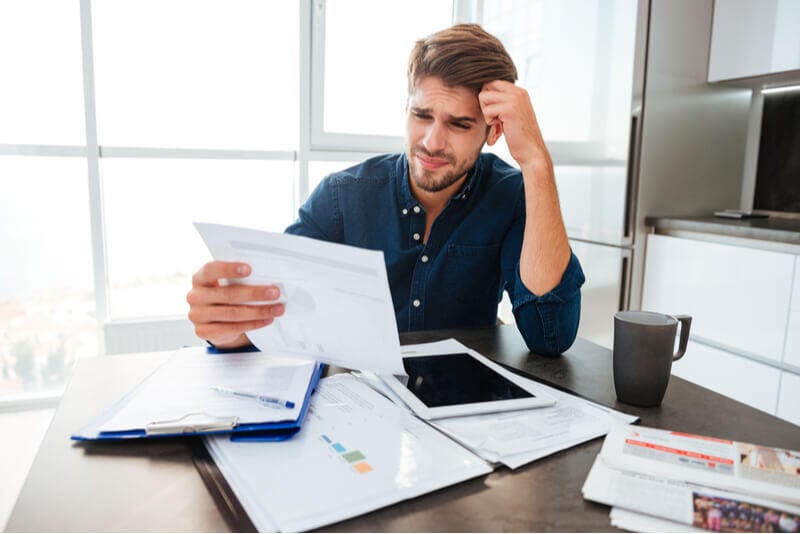

Are you interested in some intelligent crypto trading tips to make a profit? If so, this piece of content is for you! Perhaps you have heard of all the crypto success stories and the thousands of people making money.

Perhaps you even know someone who has made a steady income by mining cryptocurrency. Whatever your reasoning is for wanting to get involved, it is important to know that you can’t just ‘wing it’. Cryptocurrency is a great way to make money, but if you don’t know what you’re doing, it is also a great way to lose money.

A lot of people who don’t immediately see a profit will give up. However, with the right information, you can make a profit. The good news is that there are many great ways to make money with crypto. Let’s take a closer look!

Why You Need Crypto Trading Tips to Make a Profit

As great as it is, cryptocurrency trading isn’t all rainbows and butterflies. Yes, you can definitely make money with cryptocurrency. However, you need to remember the inherent volatility of it.

Most cryptocurrency involves a rather high degree of risk. This is why you need crypto trading tips to make a profit. Trading cryptocurrency is an excellent way to make money. Though the volatility of the market can put people off at times.

So, the potential is there if you are educated. The cryptocurrency market is still small in a way. Though, there is still great potential for growth. Some well-known cryptos are:

• Ethereum

• Bitcoin

• Cardano

• Dogecoin

• AMP

• ElonGate

• Iota

• Shiba Anu

• Moonshot

• Polygon

• Safemoon

• Stellar

• Tether

• VTHO

There are also crypto buying platforms available such as Coinbase, Binance, and Robinhood. Basically, you have plenty of options when making money with crypto.

6 Crypto Trading Tips to Make a Profit

If you are currently wondering how you can make money with crypto, here are 6 strategies/tips that can help you. We will explore these tips and strategies in depth. Let’s take a good look!

1. Investing

Investing is the most obvious and long-term crypto strategy. They are generally well suited to buy-and-hold strategies. While they are extremely volatile, they have great long-term growth potential.

The investing strategy requires you to identify stable assets that will be around for the long term. Assets such as Ethereum or Bitcoin have been known for long-term price increases. In this regard, they become a safe investment.

2. Trading

While investing is essentially a long-term endeavour, trading is meant to exploit short-term opportunities. As said above, the cryptocurrency market is extremely volatile. This means that the price can increase and decrease dramatically and frequently.

To be successful, you need to be equipped with crypto trading tips to make a profit. You will need to analyze the market performance to make more accurate predictions. When trading, you can take long or short positions.

This depends on whether you think the price of an asset will rise or fall.

3. Staking and Lending

Staking is known as a way of validating cryptocurrency transactions. If you are staking, you are able to own coins, but you never spend them. Instead of spending them, you lock the coins in a cryptocurrency wallet. Your coins will be used to validate transactions with a Proof of Stake network.

Essentially, you will be lending coins to the network. It allows the network to verify transactions and maintain security. The reward you receive from this is much like interest a bank would pay you for a credit balance.

You can also lend coins to other investors. Then you generate interest on that loan.

4. Cryptocurrency Social Media

With multiple blockchain-based social platforms, you can be rewarded for creating and curating content. You will often be rewarded with the native coin of the platform. This is a simple crypto trading tips to make a profit.

5. Crypto Mining

As the original pioneers did, you can make money with cryptocurrency mining. It is still a very much crucial component of the Proof of Work mechanism. It is where the value of cryptocurrency is generated.

When you mine a certain cryptocurrency, you will be rewarded with new coins. However, to mine cryptocurrency, you will need technical expertise and upfront investment. Though, you may be able to take out a loan originally to fund this.

6. Airdrops and Forks

To generate awareness, airdrops and free tokens are distributed. For example, an exchange may do an airdrop in order to create a large user base for a specific project. Being part of an airdrop is an excellent way to get a free coin that you can later use to trade, invest, or buy things.

The Bottom Line

When it comes to trading cryptocurrency, knowing the crypto trading tips to make a profit can be extremely helpful. If you are a beginner and looking, to begin with finance, get in touch with the Australian Lending Centre to apply for finance.

Budgeting takes hard work and perseverance, but the results speak for themselves. Use these budgeting tips to help you to manage your finances and soon you’ll be in a good position to reach your savings goals. If you need a bit of extra help managing your money, get in contact.

Budgeting takes hard work and perseverance, but the results speak for themselves. Use these budgeting tips to help you to manage your finances and soon you’ll be in a good position to reach your savings goals. If you need a bit of extra help managing your money, get in contact.