Are you in need of some additional capital? We supply mezzanine debt finance to help you complete a project, continue an expansion, or borrow additional capital.

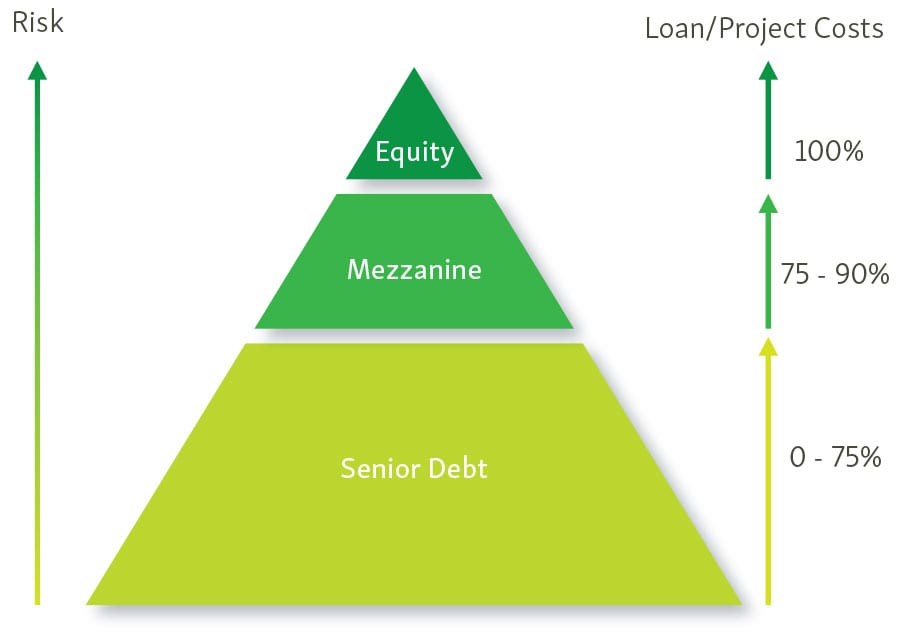

A mezzanine loan is something that helps fill in the gap between bank funding and additional costs. This subordinated debt is based on the property’s assets and equity that is projected. A second mortgage is used to secure your mezzanine finance. Australian Lending Centre can help secure your second loan once your project is ready to start or already in progress.

Mezzanine finance is taken out against your property and can fill in for cash flow crunches and can help you contribute to the purchase and development of a property. You can also hold properties for a longer duration until they’ve built up enough equity to sell.

If you need mezzanine finance, the friendly team at Australian Lending Centre can give you the information you need to see if one of our mezzanine loans is right for you.

Get started with Australian Lending Centres’ mezzanine finance options today. Whether you’re a property owner or developer, you need the cash on hand to get your development primed and ready for sale. Our extensive network of loan options can help you do it.

Continue through the form and follow through to the upload document prompts.

If approved, the funds could be transferred to your account as little as 72 hours.

For over 25 years, the Australian Lending Centre has provided access to a wide range of financial solutions including Personal Loans, Debt Consolidation and Mortgage Refinance.

Applying with us has no impact on your credit score, so you could gain approval even if you’ve been rejected elsewhere

Ⓒ 2024 Australian Lending Centre | Australian Credit License: 389119 | ACN 113 466 550 | ABN 86 113 466 550

Site by ChilliDee Digital Marketing