There was once a time where if you needed a loan, you only visited a bank. Fortunately, times have changed.

Yes, you can still go to a bank but there are now alternative; more convenient options. Non-Bank Lenders offer legitimate and competitive loans that are fast and flexible. Battling against traditional banks, Non-Bank lenders have created a competitive environment for lending in Australia.

What is a non-bank lender?

Non-bank lenders are a lender or financial institution who do not hold an Australian Banking License. Strictly speaking, they are not a bank, building society or a credit union. Non-bank lenders typically source their funds from wholesale funds either in Australia or overseas markets. They lend out these funds, with a margin. Depending on the size of the lender, they may offer mortgage, personal loans, commercial or business loans.

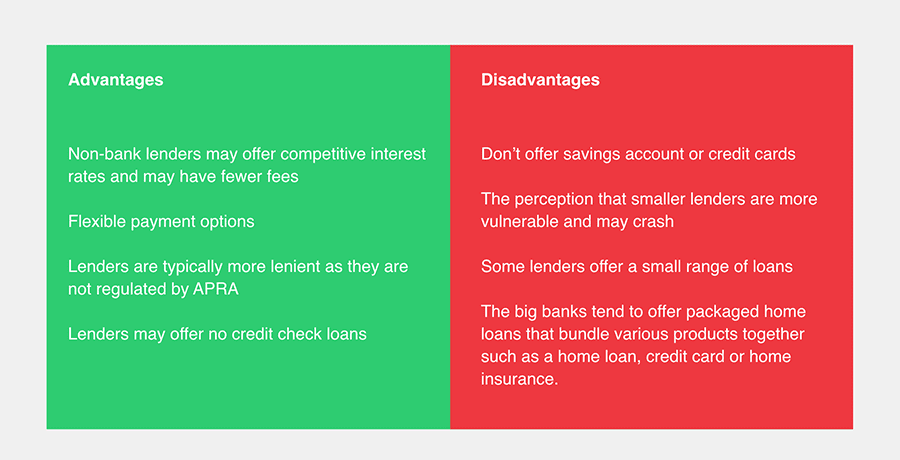

One of the key difference between traditional banks and non-bank lenders is that Non-bank lenders are not authorised to accept deposits from customers. Banks, building societies and credit unions are considered as authorised deposit institutions (ADI’s). They are regulated by APRA (Australia’s Prudential Regulatory Authority) and ASIC (Australian Securities Investments Commission). Non-bank lenders cannot accept deposits from consumers. They are regulated by ASIC.

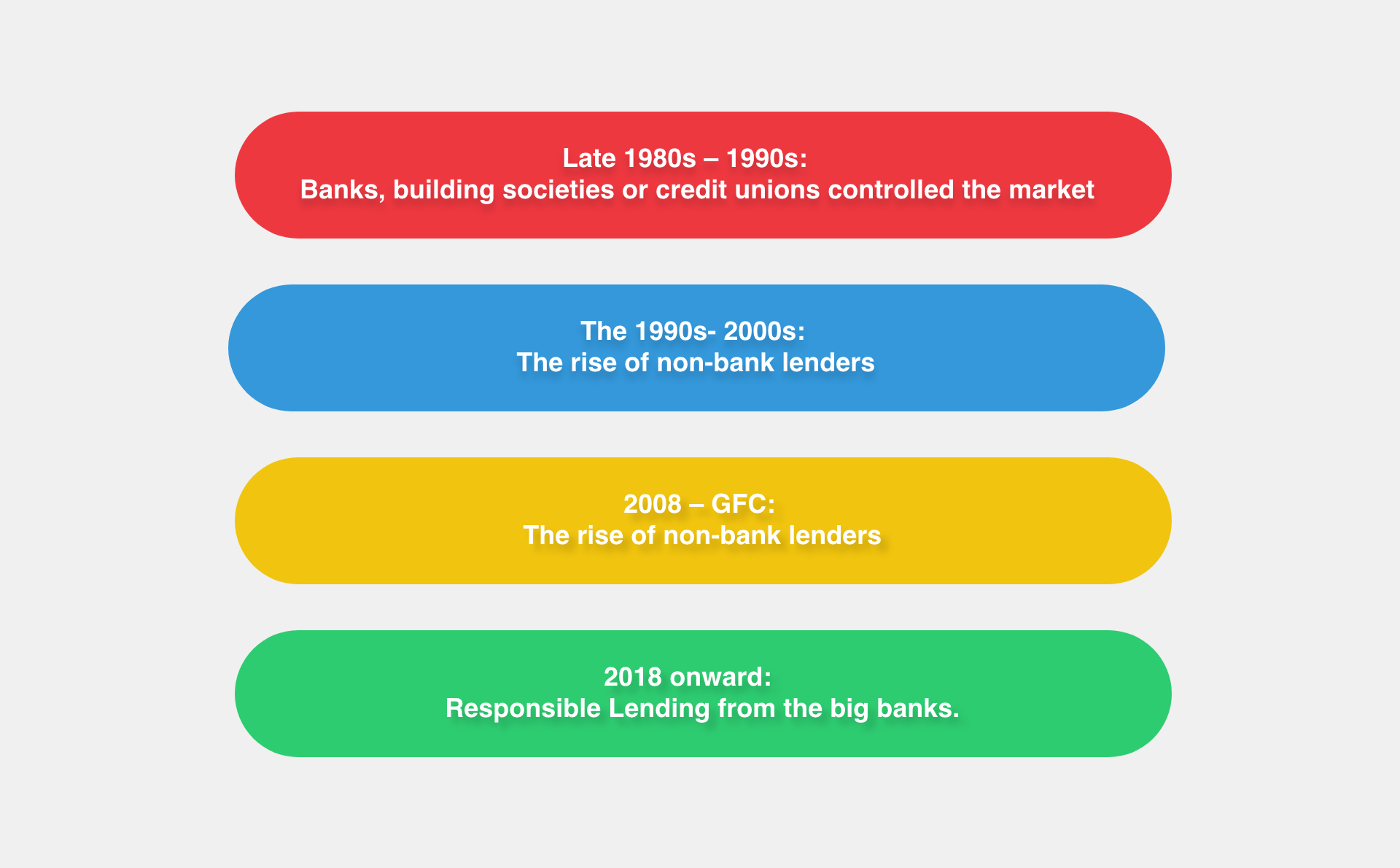

The history of non-bank lenders

Australia has a sophisticated, highly regulated and competitive financial system. There was once a time where if you wanted a loan, your only option was to visit your big bank. The process was long and draining. If you’re your income was low, you were more than likely denied for a home loan.

After the first half of the 1980s, deregulation began to slowly make its way into the market. In the 1990s, a number of non- bank lender such as Australian Lending Centre began to enter the market. These alternative forms of lending offered Australians with lower interest rates than the big banks.

Following the Global Financial Crisis, Non-Bank Lenders were forced to source alternative forms of funding. As the markets became dry, non-bank lenders even turned to the big banks for funding.

The past few years have seen a proliferation in Non-bank lenders. In 2018, Non-bank lenders reached an all-time high of 11 percent of the market. As banks move towards more responsible lending, they are tightening their lending practices. So if you are sick of getting rejected for a loan, there are alternative options out there. Consumers are becoming more wary of this and have been exploring non-bank lending options.

The Advantages and Disadvantages of using non-bank lenders

Is it safe to use a non-bank lender?

Absolutely. Non-bank lenders are safe to use. It is important to do your research beforehand. Alternative lending has evolved over the past decade. Make sure to find a lender that is not connected with bank failures. Find a reputable and well-established lender that offers a personalised loan for your financial situation.

What happens if a small lender collapses?

- If the lender is a small agency, they may be acquired by a larger well-established lending agency

- A larger financial institution may buy out the smaller lender

- The government may step in and provide financial assistance. This will come through the Guarantee scheme for large deposits and wholesale funding.

Choosing the right lender

Alternative lenders such as Australian Lending Centre have helped thousands of Australians, find the ideal loan. We have a committed team of experts that specialise in providing you with the right loan. Our goal is to help you stay on track.

To learn more about the Australian Lending Centre, click here.