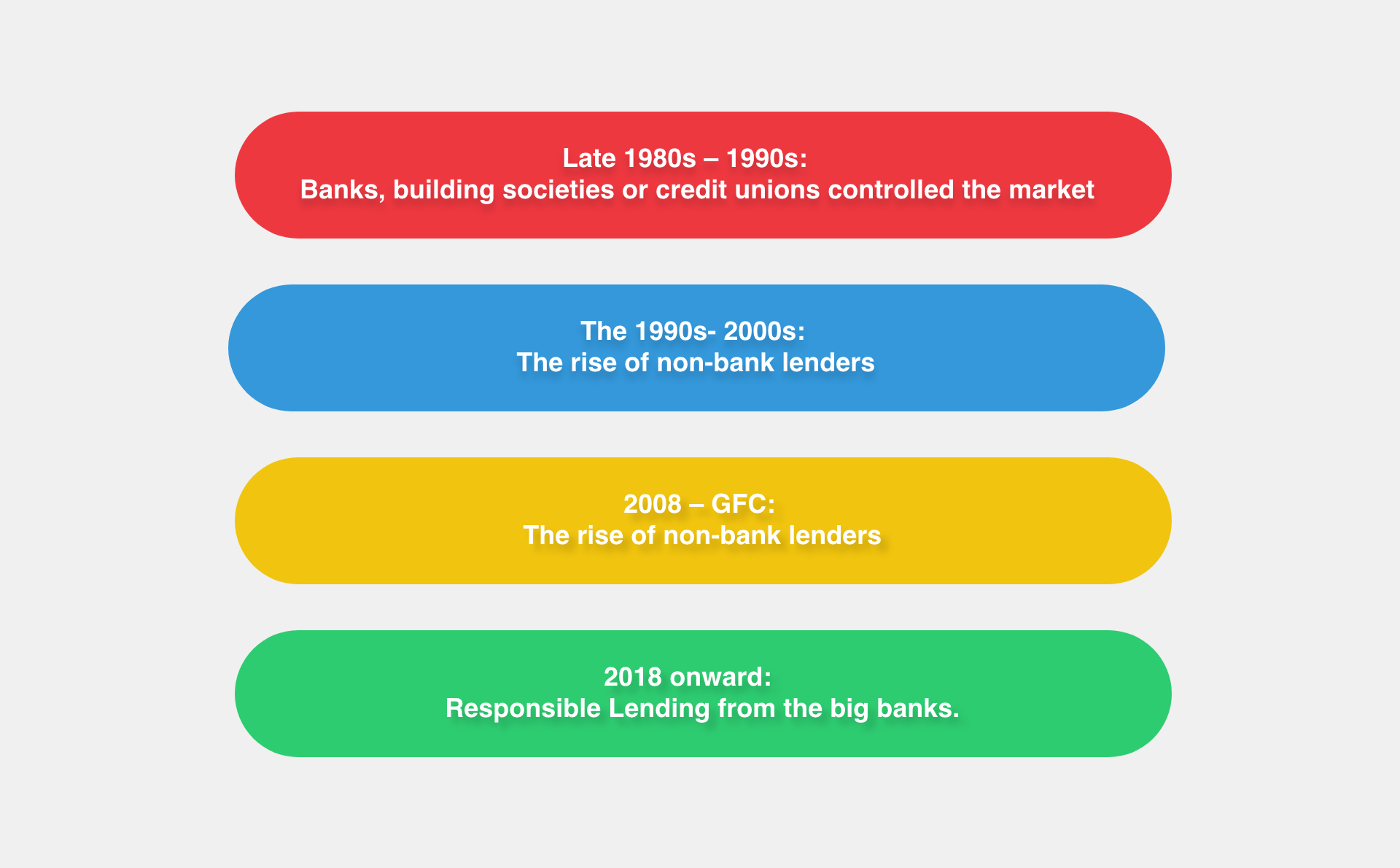

Years and years ago, if you needed a loan, you went straight to the bank to assess your available options. These days, non-bank lenders have emerged, offering a legitimate alternative to traditional lenders, and adding a competitive edge to loan marketing.

Depending on your circumstances, it may help you to step away from traditional lenders and hunt for a non-bank lender. But do you know exactly what the difference is between non-bank lenders and traditional lenders?

We will take you through both options and look at exactly how they differ in terms of what they offer to you, so you can judge which one would best meet your current needs.

What Are Non-Bank Lenders?

Essentially, non-bank lenders are exactly what you think. Non-bank lenders are alternative lenders who are not traditional banks. They don’t have a banking license and are not a mutual, ie a bank, a building society or a credit union. Nonbank lenders are called Authorised Deposit Institutions, or ADIs.

Unlike banks, they can’t accept deposits, so they have to source their money from elsewhere. They often take out a loan from the bank at wholesale rates and then lend this money on for a profit.

What are Traditional Lenders?

Traditional lenders refers to banks and other ADIs defined above. They have been the source of loans throughout history, and only recently has this turned around with the proliferation of non-bank lenders entering the market.

They are regulated very differently to non-bank lenders. Banks are largely regulated by the Australia Prudential Regulatory Authority (APRA), while non-bank lenders are regulated by the Australia Securities & Investments Commission (ASIC).

Benefits of Using a Non-bank Lender

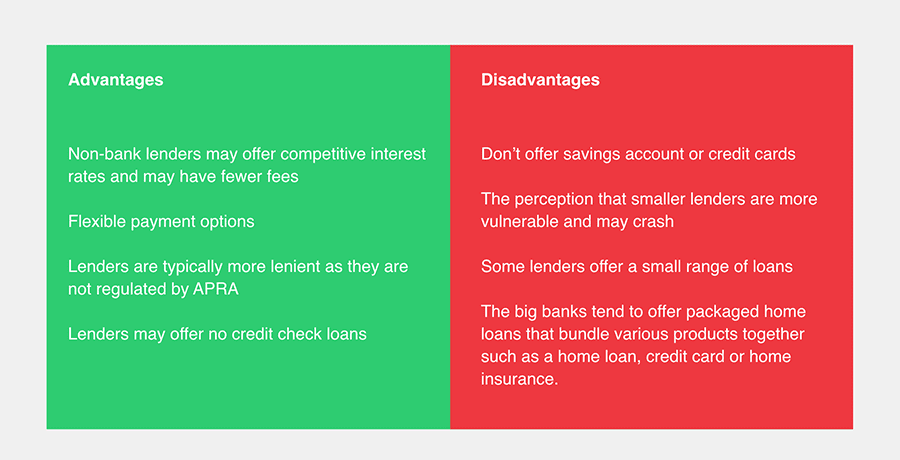

While choosing to go with a non-bank lender may not be the obvious choice, there are a number of benefits that come with using one.Lower interest rates: They borrow their funds at wholesale prices, which offers them a larger margin to work with than the banks, and can often mean they have lower interest rates than the banks. They also have limited fees as they don’t have any of the overhead costs that traditional lenders face.

Regulations: being subject to different regulations means non-banks are often a lot more flexible when it comes to lending. This enables them to tailor the process to specifically meet your needs.

Take on high risk

Whether you have a bad credit history you are trying to repair, or a business start-up, non0bank lenders are more likely to take a risk on you than traditional lenders.

Better customer service

As they are smaller than the banks, non-bank lenders often offer a more personalised approach to their customer service, so you will receive more attention to your loan and what you want out of it.

Lower down payment requirements

While banks take about 20% down payment on mortgage loans, non-bank lenders take a lot less, sitting at about 3.5%. For those who have been turned away by the bank, this is a great option to make owning their own home a possibility.

Faster approval process

With fewer hoops to jump through, non-bank lenders have a much faster approval process than traditional lenders, so you have the money in your hands even faster.

Specialists

Often, non-bank lenders can specialise in a particular loan. While traditional lenders offer an array of financial services, by specialising in just one, non-bank lends have a greater insight into that type of loan and can help you out more.

Benefits of Using a Traditional Lender

There are also some benefits that come with using a traditional lender that shouldn’t be overlooked.

Security

One of the biggest, is course, security. The banks are well-established institutions with a degree of trust built into their name. Many people feel safer with this option and sticking to what they know – especially if they already bank with them.

Less vulnerable

As banks are much larger than non-bank lenders, there is a perception that they aren’t as vulnerable to any economic hardship that may come about.

Which One Is Right For Me?

Many people perceive that traditional lenders are the best and safest option, especially when it comes to taking out a big loan, such as a home loan. This just isn’t the case anymore, and by not considering all your options, you are limiting yourself and potentially missing out on the right fit for you.

Loans Based Upon Your Unique Situation

Working out which option is best for you really does come down to your individual circumstances. You need to make a choice based on what you need the money for, what your credit situation currently is, and which service is more compatible with your needs. Shop around and find the best option for you.