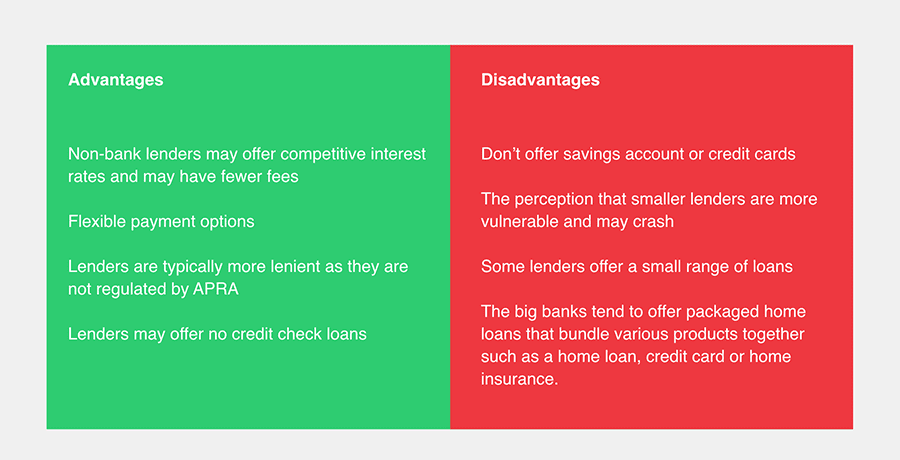

With more and more online lenders emerging in Australia, many people are beginning to question how they are being regulated and can they be trusted? This begs the question: ‘what is responsible lending?’ Essentially, it is a concept that takes a close look at the responsibilities of the two parties of a loan. The two parties being both the borrower and the lender. It isn’t just the borrower’s responsibility to ensure that they can afford the loan.

Under Australian credit license laws, it is also the responsibility of the lender to ensure that the loan is suitable for the borrower. However, with many things happening in Australia, the lines have become blurred. Nowadays, responsible lending is something that is so important, yet so ignored.

Many lenders have been failing to adequately assess the applicants resulting in many missed payments. Keep reading to learn more about what is responsible lending in Australia.

What is responsible lending?

Many parts of the country have seen a significant property market downturn. This means that lending practices have seen a plethora of borrowers, most of whom took out multiple loans, fall into financial hardship. Many of them are claiming that lenders should have never been able to approve them in the first place.

So, what is responsible lending? Responsible lending occurs when both the borrower and lender have met the requirements and responsibilities on their behalfs. This is to ensure that the borrower is able to repay back the loan and continue making repayments. This is incredibly necessary.

Previously, responsible lending has been thrown out the window, but it is more important than people think. Being approved for a loan quickly and easily may sound good. However, it can sometimes be the devil in sheep’s clothing. Let’s talk about what responsible lending looks like next.

What does responsible lending look like?

Here are some things to remember so that your loan won’t cause you hardship now or in the future. Lenders should assess your:

• Assets

• Income

• Any details that may affect your ability to make your loan repayments

• Fixed and variable expenses

• Your living situation

• Any existing debts

• The number of people who are currently financially dependent on you

• Your employment situation

To ensure that you have chosen a good lender, make sure they ask the things above. They must also request the appropriate documentation such as recent payslips. As said above, quick and easy loans sound good, but loan application forms are long for a reason. Appreciate them for the safety they give you when borrowing. That is why you need to know what is responsible lending.

How lenders make their decision

To truly know what is responsible for lending, you should know how the lenders make their decision. Behind the scenes, they will carefully consider things such as:

• The amount of disposable income you have that will serve as a safety buffer if market conditions are to change

• What assets you will be able to use in order to secure your loan

• What other existing debts you have that could affect your ability to pay back your loan

• Whether or not your income sources are reliable over a long period of time

Being asked a lot of questions can be annoying, but it is all worth it. It can easily feel daunting when you see all of those questions. However, your lender isn’t judging you or making it hard on purpose. They want to help you to ensure that the loan will not hurt you in the long run.

ASIC regulatory guide on responsible lending

There are certain expectations for meeting the National Credit Act’s responsible lending standards. All lenders are required, by law, to take these three steps.

• Make reasonable inquiries about the consumer’s financial situation, and their requirements and objectives

• Take reasonable steps to verify the consumer’s financial situation by making a preliminary assessment

• Make a preliminary assessment (if you are providing credit assistance)

or final assessment (if you are the credit provider or lessor) about

whether the credit contract or consumer lease is ‘not unsuitable’ for the

consumer (based on the inquiries and information obtained in the first

two steps).

Not following through with these standards is a punishable offence. Severe fines, bans, or even remediation for affected customers can be expected. The lender in question will also have to deal with bad publicity and a bad reputation.

The bottom line: what is responsible lending

Do you require help with your finances? Well, the Australian Lending Centre makes applying for finance easier than ever! All you need to do is complete our online enquiry form and then wait to hear from us. The form won’t take any longer than 30 seconds.

We will carefully consider your application and discuss your situation over the phone to ensure that you are able to meet the terms of the loan. If your application is approved then you will receive the funds within as little as 24 hours!