If you haven’t been living under a rock, you will have likely heard of the Low and Middle Income Tax Offset (LMITO). It has now become law, and what it essentially means is that you may be eligible to receive $1,080. However, this depends entirely on your income. So

LMITO was created to help low and middle-income tax earners to reduce the amount of tax that they pay. It can only be used to lower your tax bill because it is a tax offset. This also means that it can’t be used to generate a tax refund or pay your Medicare levy. Let’s dive in and learn a little more about it and how to get it.

What is the Low and Middle Income Tax Offset?

LMITO was actually temporary when it first came out. Canstar says ‘The Low and Middle Income Tax Offset was originally introduced as part of the Australian Government’s Personal Income Tax Plan in the 2018 Budget’. It was for the four financial years between 1 July 2018 and 30 June 2022. This was set to be stage 1 of the coalition governments Personal Income Tax Plan. It was then that stage two was decided.

Stage 2 was due to come into effect from 1 July 2022. It would set the Low and Middle Income Tax Offset to increase. On top of that, the 32.5% tax bracket would be expanded from incomes up to $90,000 to incomes up to $120,000. This would then essentially replace the need for LMITO.

However, in 2020, the government announced that they would bring forward stage 2. They then also announced that the Low and Middle Income Tax Offset would be extended for the 2020/21 financial year.

Who is eligible for the low and middle tax offset?

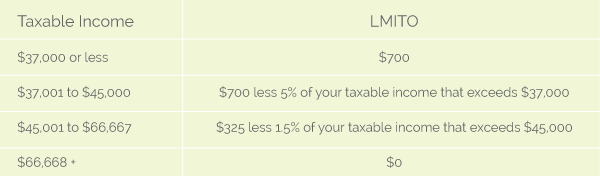

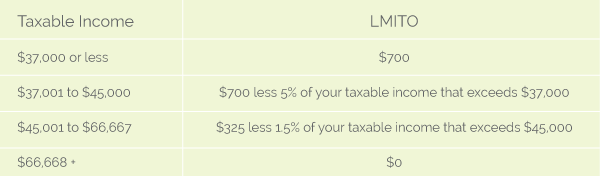

To know whether or not you are eligible, you will need to assess your taxable income. If your taxable income is equal to or below $126,000, you will be eligible for some LMITO. There is absolutely no need to apply. The ATO will work out if you’re eligible or not when they assess your tax return.

It is said that around 4.5million Australian taxpayers will be eligible for the full $1,080/ However, another 5.6 million will receive a partial tax offset. The LMITO:

- Is not allowed to be used to reduce tax payable on unearned income of minors

- Does not have to be applied before other non-refundable tax offsets

- Cannot be carried forward or transferred

- Is not refundable

The bottom line is that you do not have to apply, it will be worked out for you.

The Spouse Contributions Tax Offset

Whether husband, wife, or de facto, if your spouse is earning somewhere between 37,000 and $40,000 or not even working at the moment, there is a large chance that they are accumulating very little or no super at all to fund their retirement.

There is a way to help them by putting money into their super. If you do this, you may be eligible for a Spouse Contributions Tax Offset of up to $540 depending on the eligibility requirements. This is very helpful to know as it is a piece of information that isn’t often shared.

The Low Income Super Tax Offset

You may be eligible for a Low Income Super Tax Offset (LISTO) if you earn up to $37,000 a year. You could pocket around $500 per year for this. To get it, you do not have to do anything. You only need to make sure your super fund has your tax file number.

It is then that the ATO will work out whether or not you’re eligible. From then, you will have the money paid into your super account. Essentially, the LISTO refunds the tax that low-income earners have to pay on their before-tax super contributions.

What if I am not eligible for the Low and Middle Income Tax Offset?

If you’re not eligible for the low and middle tax offset then it isn’t the end of the world. Luckily, there is good news for you.

The government has recently made many changes to the income tax rates applied to taxable incomes. This means that there has been a significant reduction in personal income tax rates. This can help many people if they’re not eligible for the Low and Middle Income Tax Offset. Though, if you’re in need of money and not eligible, a personal loan can help.

How to spend it

Nobody can tell you how to spend your money. However, statistics suggest that 50% of gen z are planning to save the extra income from tax offset, while 77% of boomers are planning on spending it. The smartest way to use it is to pay off debt, that is obvious. It may not be the most popular choice, but it is definitely recommended.

Contributing even the smallest amount of money can help to balance your debt out. This is a positive way to use the offset. Spending it on non-essentials isn’t a good idea. But if you do need essential groceries or some repair work on your house, go ahead.

Do you need help?

If you’re struggling with your finances, don’t worry, there is help available to you. The Australian Lending Centre has a wide array of finance options available. You can very quickly find the help you’re after. The Australian Lending Centre has been helping Aussies with their finances for over 25 years.

Contact the Australian Lending Centre today and say goodbye to any financial worries.