If you have lodged, or are yet to lodge your tax return you may, you may be happy to know that your tax return could be $1,080 bigger. This bundle of joy comes in the form of the low and middle-income tax offset, which will be handed out to Australian taxpayers earning up to $126,000 a year.

What is the low and middle tax offset?

In the 2019-2020 Federal budget, the Coalition Government announced its intention to revise the Personal Income Tax Plan. The proposal has now passed Parliament and has started to roll out across this year’s tax returns.

The low and middle-income tax offset is designed to help Australians lower the amount of tax they have to pay. As an offset, it will directly reduce the amount of tax payable. Unfortunately, the LMITO will not reduce the Medicare Levy for taxpayers, but it will reward over 70% percent of hard-working Australians with some extra cash.

Are you eligible for LMITO?

With approximately 650,000 Australians lodging their tax return in the first week of July, it is clear that many are already rushing to claim the tax offset. The ATO also estimates that 4.5 million Australians will be eligible to claim the full LMITO of $1,080, with another 5.6 million receiving partial payment. Whether you are eligible is entirely up to your taxable income.

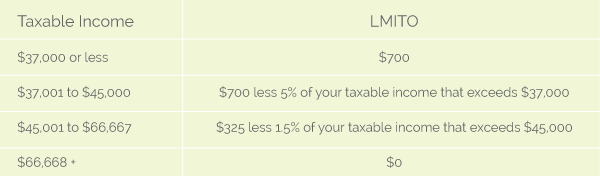

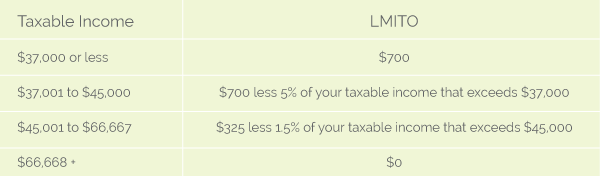

LMITO taxable income thresholds

The following thresholds apply for the 2018/2019 financial year

Example: Oscar

Over the 2018/2019 financial year, Oscar will earn a taxable income of $70,000.

Oscar will receive the full refund of $1,080.

Example: Shannon

Shannon is a paralegal working at a law firm in the CBD. Her taxable income for the 2018/2019 financial year is $47,000. Her LMITO will be calculated as follows;

$255 + (7.5% x ($47,000 – $37,000))

= $255 + (7.5% x $10,000)

$255 + $750

= $1,005

Shannon will be entitled to receive a refund of $1,005

Example: Jason

This financial year Jason will earn a taxable income of $108,000. His LMITO will be calculated as follows;

$1,080 – (3% x ($108,000 – $90000))

= $1,080 – (3% x $18,000)

$1,080 – $540

= $540

LMITO =$540

How do I get my LMITO?

If you are eligible for the tax offset, the refund will automatically reflect on your tax refund. The money will be deposited into your nominated bank account. According to the ATO, you do not need to request an amendment.

What’s next?

The government’s tax reform is based around two more stages of stage reform, beginning in 2022-23 and the final reform in 2024-25.

Low Income Tax Offset: 2022/2023

Some will benefit more than others. High-income earners will benefit as they will receive a larger tax cut. For example, in the third stage of the government’s tax plans, a high-income earner receiving $20, 0000 may receive an offset of $11,640.